south dakota sales tax calculator

South Dakota is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. Colorado has a 29 statewide sales tax rate but also has 276 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4079 on top of the state tax.

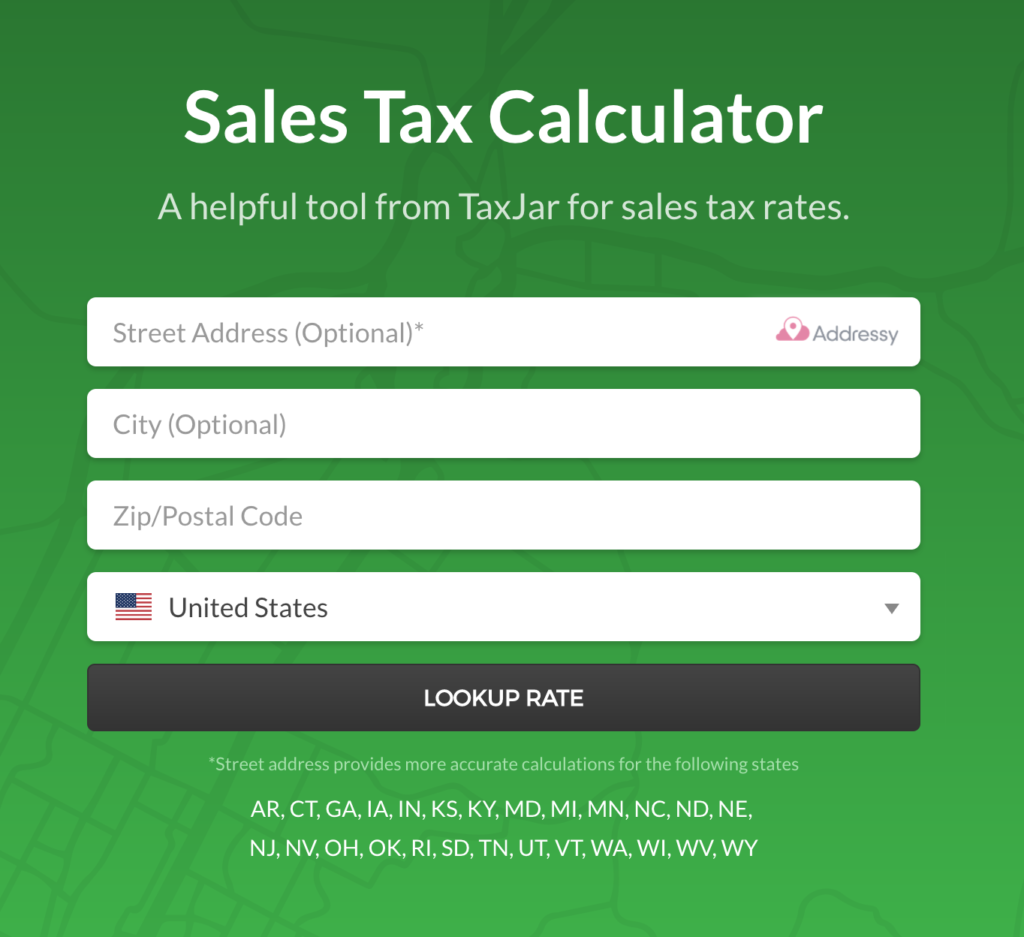

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

This means that depending on your location within Colorado the total tax you pay can be significantly higher than the 29 state sales tax.

. The jurisdiction breakdown shows the different sales tax rates making up the combined rate. Be sure to apply the. While most taxable products are subject to the combined sales tax rate some items are taxed differently at state and local levels.

Because South Dakota is a member of this agreement buyers can use the Multistate Tax Commission MTC Uniform Sales Tax Certificate when making qualifying sales-tax-exempt. The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted.

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

Sales Use Tax South Dakota Department Of Revenue

South Dakota Sales Tax Small Business Guide Truic

Income Tax Calculator 2020 2021 Estimate Return Refund

South Dakota Income Tax Calculator Smartasset

Sioux Falls South Dakota S Sales Tax Rate Is 6 5

Sales Use Tax South Dakota Department Of Revenue